04

2023

-

01

2023 layer chicken industry boom recovery, unstoppable

The overseas bird flu epidemic has led to limited introduction, and the inflection point in the stock of ancestral chickens has been reached;

In 2023, the total number of laying hens will be slightly higher than the 2022 forecast, the stock structure is expected to be the opposite of 2022, the proportion of young and middle-aged high-yield laying hens has increased, the proportion of old chickens has decreased.

A sharp drop in feed prices in 2023 may be inevitable.

part 1

Overseas bird flu outbreaks have led to limited introductions, and the inflection point in the stock of ancestral chickens has been reached.

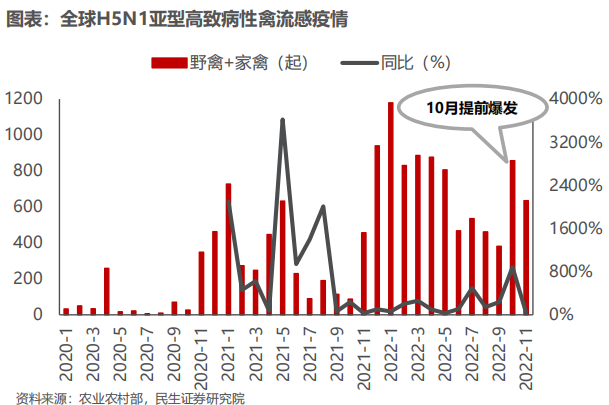

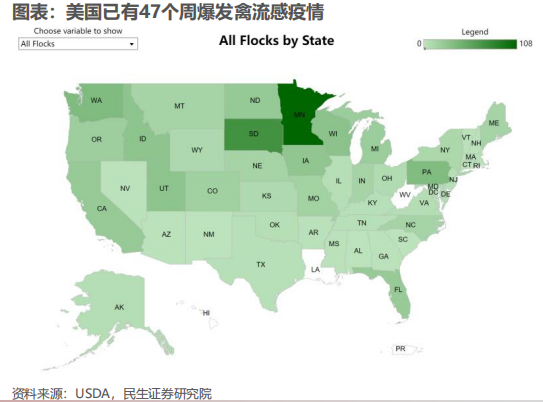

The current overseas outbreak of highly pathogenic avian influenza began in April 2020, and the impact of the past two years has been particularly severe. Generally speaking, December to May of the following year is the season of high incidence of bird flu, but the epidemic broke out ahead of schedule in October 2022, involving a large scale and wide coverage. According to data from the Ministry of Agriculture and Rural Affairs of China, as of the end of November, there were 3762 bird flu cases in the world in 2022, and the number of poultry deaths and culling was 90.28 million, which has exceeded the total of 2020 and 2021. Among them, the United States, as an important exporter of poultry meat and ancestral breeders in the world, accounted for about 1/3 of the global total from January to November this year.

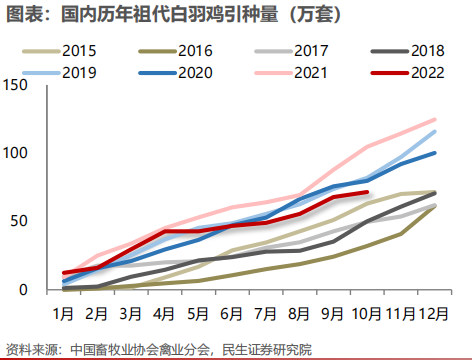

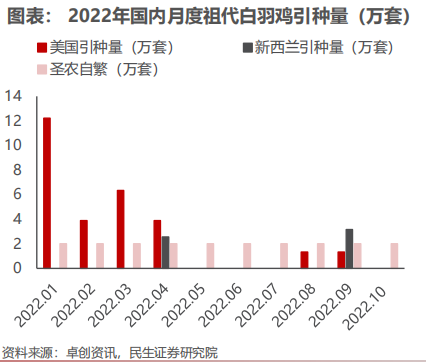

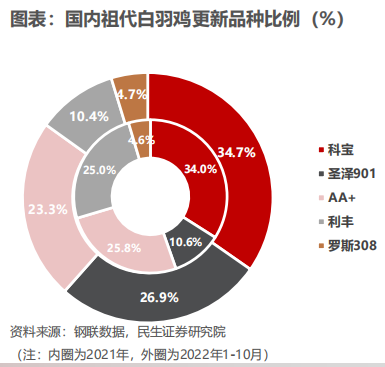

In recent years, the main supplier of ancestral breeders of Chinese white feather broilers is the United States, accounting for about 50% of the total introduction (renewal). The early outbreak of the epidemic has made the already inadequate introduction more stretched, as of the end of November, the U.S. ancestral chicken supply capacity fell by about half, the domestic since May 2022 began to limit the introduction, until July, the white feather ancestral introduction continued to be 0. August-October, although the policy liberalization, but the introduction of very few, November introduction again cut off, January-November ancestral renewal of 716000 sets, to maintain a low level, year-on-year -37.5, supply shortage is basically determined.

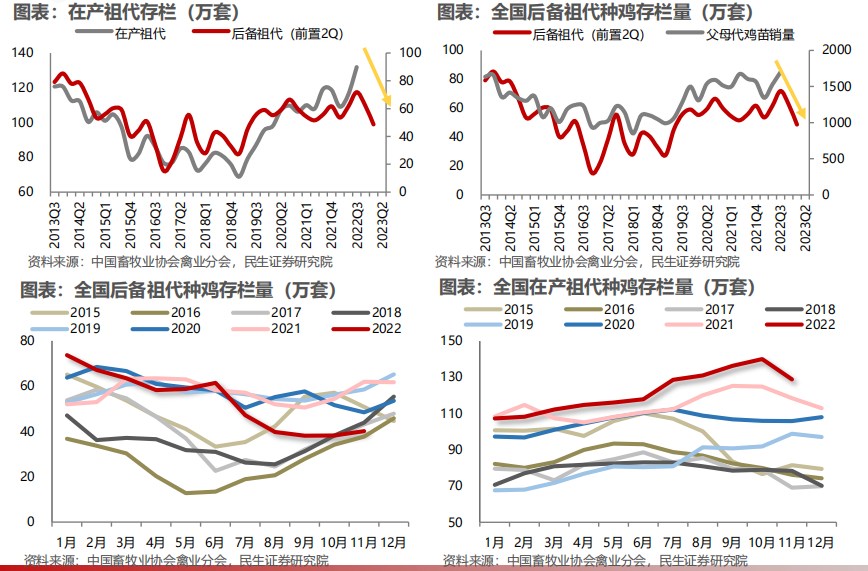

As of the end of November 2022, the national reserve ancestral chicken column only 401000 sets, down more than 50% from the highest point of the year, the national production of ancestral chicken column 1.288 million sets, month-on-month -8.0.

The decline in the stock of reserve ancestral breeders will be roughly transmitted to the supply of the stock of ancestral breeders and parental breeders after 2Q, and the introduction decline that began in the second quarter has begun to be reflected in the supply of parental breeders after entering the fourth quarter. According to the association's data, the average price of parent-generation chicken seedlings in October was 28.1 yuan/set, up 11.6 percent month-on-month; in November, the average price of parent-generation chicken seedlings was 43.9 yuan/set, up 56.4 percent month-on-month, up 13.2 percent year-on-year.

part 2

The essence of the chicken cycle is the parental price cycle.

The price of parent generation chicken seedlings is the wind vane of the industrial chain, and has now entered the rising channel.As of October 10, 2022, the country in the production of parent generation chicken column 18.593 million sets, has shown a downward trend, we expect from the end of the year to the first half of next year parent generation chicken supply will continue to be tight, meaning that the price of chicken seedlings still has upward space, from the valuation point of view we recommend low participation.

The worst point in performance has passed, and the companies closest to the upstream are the first to benefit.

Source: Minsheng Securities

Analysts: Zhou Tai, Xu Wei, Zhang Xinyi.

part 3

In 2023, the stock of high-yield laying hens is expected to change.

The laying hens industry will basically come to an end in 2022. Judging from the average egg price for the whole year, the total stock of high-yield laying hens for the whole year will basically remain at a slightly lower level around the supply-demand balance point. However, the total stock of high-yield laying hens in the second half of the year will be slightly higher than that in the first half of the year. Starting from the price increase in July 2022.

However, the annual average monthly average chicken seedling supplement amount, subject to high cost suppression, the supplement amount tends to the normal level slightly lower, did not increase significantly, then the peak of the strong annual chicken flock, to maintain a relatively stable level. The increase of chicken seedlings only started in October and has gradually increased, which has no impact on the market in 2022.

The accumulation of old chickens in half a year, the total stock of high-yield laying hens is much higher than that in the first half of the year, but there are many old chickens, and the laying rate does not have the same number of peaks. Laying hens have a large egg production, the total number has gone up, the production has not accumulated significantly, and the price drop is not large.

With the arrival of the time point before the phased Spring Festival and the periodic low level after the Spring Festival, the old chicken will fluctuate with the passage of time, and the phased elimination will accelerate and speed up the production of the old chicken.

In 2023, the stock of high-yield laying hens is expected to change. The total number of laying hens will be slightly higher than that in 2022. The stock structure is expected to be opposite to that in 2022. The proportion of young and middle-aged high-yield laying hens will increase and the proportion of old hens will decrease.

With the past three years of wandering and shaking to reduce production capacity, laying hens have had too long and too many empty cages, and there are more empty and half-empty chicken farms, and some will start to load chickens one after another. The number of young and middle-aged chickens in stock has increased. From the current sales plan of breeding chicken enterprises and young chicken enterprises, one or two trends can be basically seen;

The overall stock has increased, which means that the supply of fresh eggs has increased. Theoretically, without external factors, the average egg price should be slightly lower than 2022. Every time the egg price hovers at a low level, it will accelerate the elimination of old chickens with low egg production rate, clear the backlog of old chickens behind, and optimize the overall industry stock structure.

If the raw material price of corn and soybean meal reaches the inflection point and starts to fluctuate slightly downward, even if the average egg price for the whole year drops somewhat, 2023 will still be a year worth looking forward to for small and medium-sized farms with relatively low cost. However, when the cost of medium and large-sized farms without core competitiveness is not dominant, it may be another year to serve the people.

Of course, the stock and structural changes, is a dynamic and rapid change process, external factors affect the supply and demand fluctuations change quickly, the final trend, continue to observe and verify, only for everyone's entertainment reference exchange, not for the final investment reference, do not blindly follow!

Source: Laying Hens Circle Comprehensive Author: Anonymous

part 4

2023 material prices or will be high down, the overall recovery of the poultry industry or has been irreversible!

The pace of 2023 is close at hand. For breeders, the past year, however difficult, is a thing of the past. But in the coming new year, we are expected to usher in a long-lost good situation. Because next year's feed will probably go down at a high level.

First of all, in the past three years, feed prices have been raised again and again, and the cost of breeding has almost doubled, which makes farmers miserable. The reasons for the abnormal rise in feed prices include the rising cost of feed raw materials and the "man-made" factors of feed manufacturers.

Due to various reasons such as the problem of masks and the poor circulation of international bulk commodities, the prices of major raw materials for feed such as soybean meal have soared in the past two years, which directly increased the price of finished feed. In addition, the overall downturn in the breeding industry and weak feed demand have also brought great pressure to the survival of feed manufacturers. In order to ease the operating pressure, the major feed manufacturers have to take advantage of the reasons for rising raw materials to increase prices. However, such behavior of feed manufacturers is tantamount to drinking poison to quench thirst and shooting themselves in the foot. When a large number of farmers were forced to withdraw from the aquaculture industry, the days of feed manufacturers came to an end.

Since the beginning of this year, many small and medium-sized feed mills have completely withdrawn from the stage of the industry. And next year, will be the existing feed manufacturers to compete for market share of the year. Next year's "record" will determine the future of major feed manufacturers in the industry's market positioning. Therefore, next year to further seize market share has become the main theme of the feed industry. Recently, major feed companies have also planned to further expand production capacity and sales in 2023. According to the data learned, Dabei Nong has set a target of 10% market share in the near future, 20% in the medium and long term, and 30% in the long term.

In order to quickly seize the market, the major feed enterprises are bound to take measures to reduce the price of sales. Even the previously tried-and-tested means of selling feed on credit will return to the world. Coupled with the end of the mask problem, international commodity prices such as soybean meal are expected to continue to fall. Since October 2022, the price of soybean meal has been lowered several times, which is a clear signal.

Therefore, whether from a subjective or objective point of view, a sharp drop in feed prices in 2023 may be inevitable.

Related News